Rising consumer demand for economical protein sources is driving the poultry industry’s growth as it is poised for the next phase of growth-Ricky Thaper (www.rickythaper.com)

India has a vast livestock and poultry resources that play a vital role in improving the socio-economic conditions of rural communities. As per the 20th livestock census, 2019, there are about 303.76 million bovines – cattle, buffalo, mithun and yak), 74.26 million sheep, 148.88 million goats, 9.06 million pigs and about 851.81 million poultry. The Indian poultry sector has played a crucial role in meeting protein and nutritional needs of a vast section of the population. Currently while the production of agricultural crops has been rising at a rate of 1.5 to 2 percent per annum, that of eggs and broilers has been rising at a rate of 7-8 percent per annum.

Poultry production in India valued at $ 30 billion has taken a huge leap in the last four decades, emerging from conventional farming practices to commercial production systems with state-of-the-art technological interventions. Currently the sector is estimated to employ more than 6 million people either directly or indirectly. The small and medium size farm (5000 birds onwards) are mostly engaged in contract farming systems under larger integration companies.

According to the Ministry of Fisheries, Animal Husbandry, and Dairying, the poultry sector grew 8% annually during 2006-07 to 2021-22. The poultry meat output of 4.5 million tonne (MT), contributed to 51.4% of the total meat production of 9.3 MT in 2021-22. However there has been regional concentration of production of poultry meat and eggs in the country.

A report titled “Vision 2047″: Indian Poultry sector by Confederation of Indian Industry (CII) has stated that the growth in the poultry sector in the country has been attributed to the commercial poultry industry which accounts for 85% of production while the rest of 15% of the output comes from the traditional backyard poultry.

India has transformed their poultry farming industry through major investments in breeding, hatching, rearing, and processing of chicken. India, as the third-largest producer of eggs (129.60 billion) and the fifth-largest producer of poultry meat (4.5 million tonnes) globally. As per the FAOSTAT, the USA has 17% share in global poultry meat production followed by China (12%), Brazil (11.7%), Russia (3.8%) and India (3.5%).

Govt’s support to the sector

The government has been supporting the growth of the poultry sector through several initiatives like dedicated funds for setting up units, disease surveillance and providing support for ensuring supply of animal feed for the sector. Under the Animal Husbandry Infrastructure Development Fund was launched with a corpus of Rs 15,000 crore in 2020, was recently extended for three years till 2025-26 under Infrastructure Development Fund (IDF) with an outlay of Rs 29,610 crore. The centre government provides a 3 per cent interest sub-vention to the borrower and credit guarantees up to 25 percent of total borrowing. The interest subvention is for 8 years including two years of moratorium for loan up to 90% from the scheduled bank and National Cooperative Development Corporation (NCDC), NABARD.

There are more than 5000 odd project proposals have been received under the fund which aims at incentivizing investments for Dairy processing and product diversification, Meat processing and product diversification, animal feed plant, breed multiplication farm, animal waste to wealth management (agri-waste management) and veterinary vaccine and drug production facilities. Investment proposals for the modern poultry farms and feed plants have availed funds under the scheme. The stakeholders including Indian Dairy Association (IDA), All India Poultry Breeders Association (AIPBA), Compound Livestock Feed Manufacturers’ Associations (CLFMA), All India Livestock and Meat Exporters’ Association (AILMEA), Poultry Federation of India (PFI) and other associations have been asked by the Animal Husbandry Department, Government of India, to create awareness about the scheme.

The World Organisation for Animal Health (WOAH) has approved India’s self-declaration of freedom from Highly Pathogenic Avian Influenza (HPAI) or referred to as bird flus in specific poultry compartments. Compartmentalization is a crucial tool that enhances animal health, reduces the risk of disease outbreaks within and outside the compartment, and facilitates the trade of poultry and poultry-related products, according to an official statement. The Department of Animal Husbandry & Dairying has submitted a self-declaration of freedom from High Pathogenicity Avian Influenza in 26 poultry compartments in four states – Maharashtra, Tamil Nadu, Uttar Pradesh, and Chhattisgarh to the WOAH.

During the 2022-23, India exported poultry and poultry products worth $ 134 million to 64 countries. The approval of this self-declaration is expected to boost Indian poultry in the global market.

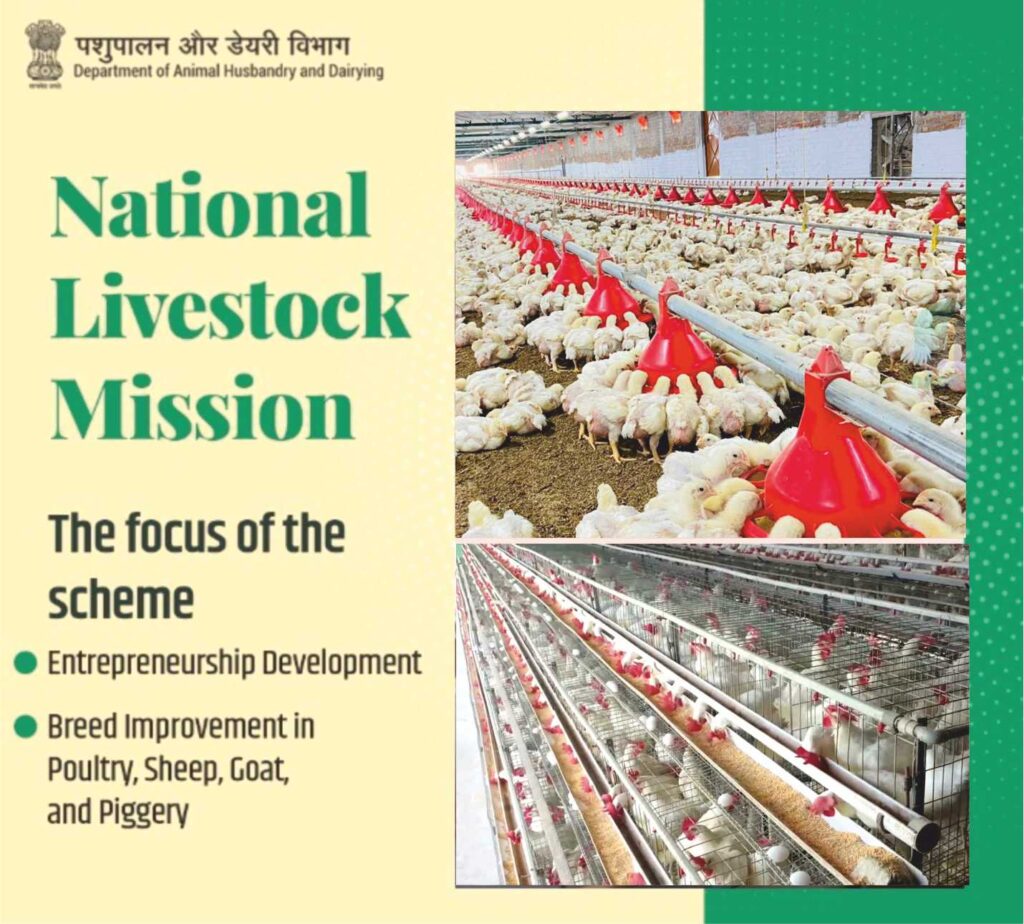

Under the National Livestock Mission’s submission on Breed Development of Livestock & Poultry aims at bringing sharp focus on entrepreneurship development and breed improvement in poultry, sheep, goat and piggery by providing the incentivization to the eligible entities like Individuals, Farmers Producers Organizations, Farmers Cooperative Organizations, Joint Liability Groups, Self Help Groups, Section 8 companies for entrepreneurship development and also to the State Government.

Feed supply with rising demand remain a challenge for the sector:

There has been increasing diversion of maize towards industrial use and ethanol production. Due to limitation of diversion of sugarcane towards ethanol production and to meet rising demand from animal feed and biofuel manufacturing, the government is aiming to increase production of maize by 10% to 42 million tonne (MT) by 2025-26 from 38 MT in 2022-23 crop year through initiating measures such as crop diversification, cluster development for ethanol plants and involving private sector in seed development. About 60-65% of the output of maize is used as poultry and animal feed while 20% is used for industrial use.

However, the current growth level of maize and soybean production in the country will be insufficient to meet the demand of the poultry industry. The industry associations have urged the government to allow imports of GM maize and soybean because of ‘unprecedented increase’ in prices. In August 2021, the government had relaxed import rules to allow the first shipment of 1.2 MT (million tonne) of Genetically Modified soymeal to support the domestic poultry industry after a record spike in feed prices. Several south Asian countries including Bangladesh, Nepal and Sri Lanka have allowed imports of GM soymeal. The composition of animal feed is 65-70% is energy source mostly from maize, bajra and broken rice while rest is protein source mostly from soybean meal.

Poultry protein promotion: a collaborative effort

Chicken meat and eggs are perceived as healthier alternatives to red meat, driving up demand. Poultry products are often more affordable than other protein sources, making them accessible to a broader segment of population. In the post Covid19 pandemic phase the demand for the protein rich food like poultry meat and eggs have increased sharply. The growing awareness regarding health and wellness is further driving the demand for a protein-rich diet.

Chicken meat is a high-quality protein containing all nine essential amino acids in right proportions. It’s a Lean Protein with high nutrient density. Means it provides essential vitamins and minerals also including B complex vitamins, selenium, phosphorus and niacin. Chicken protein also helps in muscle management and growth; hence it is very popular and essential for athletes and individuals looking for building the muscle mass.

To promote poultry meat as key driver of increasing protein intake, Poultry Federation of India (PFI) organize a meeting on Poultry Protein jointly with the United Soybean Board (USB), USA Poultry & Egg Export Council (USAPEEC), and the World Veterinary Poultry Association (WVPA). The objective of this meeting is to pitch for promotion of chicken and eggs as the premier source of protein for consumers.

Additionally, various other associations including CLFMA of India, NECC, All India Poultry Breeders Association, IPEMA, Vets in Poultry, INFAH, Karnataka Poultry Farmers & Breeders Association, Andhra Pradesh Poultry Federation, Telangana Poultry Federation, Poultry Breeders Association-Telangana, Poultry Farmers’ and Breeders’ Association-Maharashtra, Broiler Breeders Association-North, North India Broiler Producers Association, Central Haryana Layer Poultry Farmers Association, West Bengal Poultry Federation, along with other regional and state-level associations, are collaborating towards promote chicken and eggs within their respective regions.

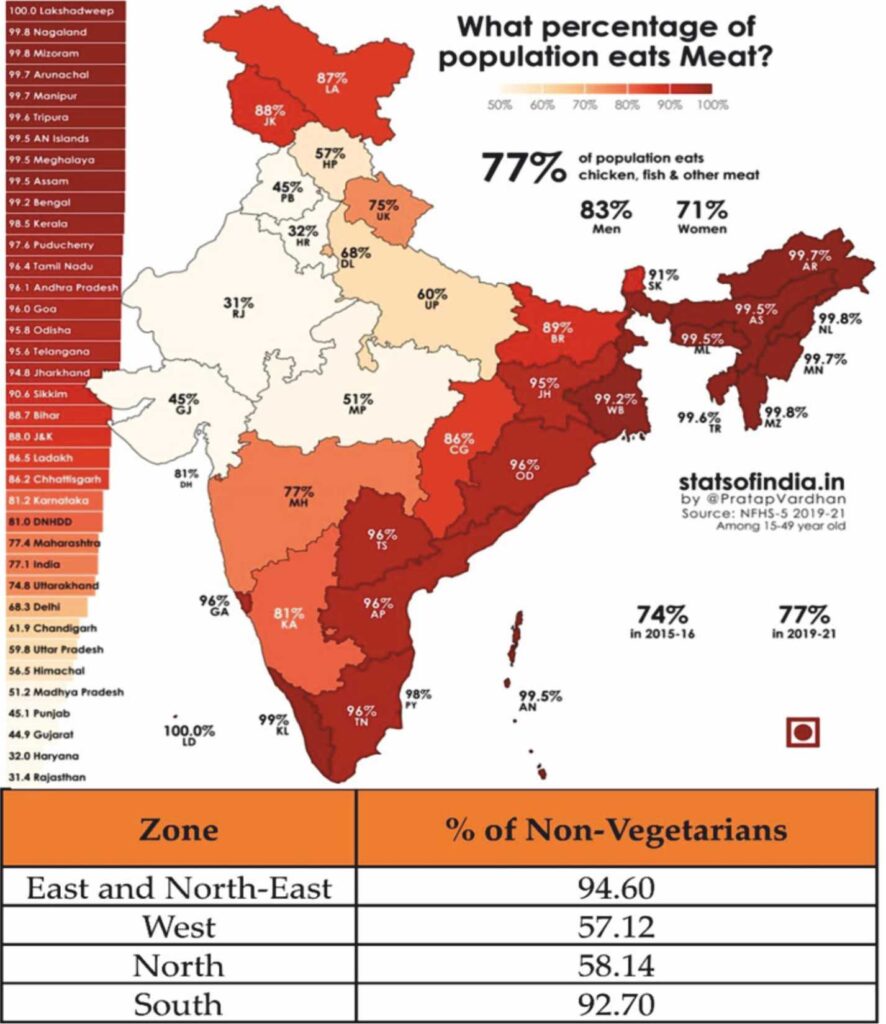

Figure 1. Pictorial description on meat eating population in India.

The data indicate the potential growth for chicken eating population in India.

A major chunk of the country’s population eats non-vegetarian food. The poultry meat and eggs remain one of the healthy and economical sources of protein. Post Covid-19, several consumers have added poultry meat and eggs to their diets. There are several international companies willing to invest in the Indian poultry sector which is witnessing a steady growth rate over the decades. The government must take proactive measures to improve feed supplies so the growth and value-addition of agriculture and allied sectors such as poultry, dairy and shrimp farming is sustained. As 100% Foreign Direct Investment is permitted through automatic route in the food processing sector including poultry sector, there is a huge opportunity for upgrading infrastructure, breeding, medication, feed production, vertical integration and processing and there are several multi-national companies that have envisaged plans to invest in the Indian poultry sector.