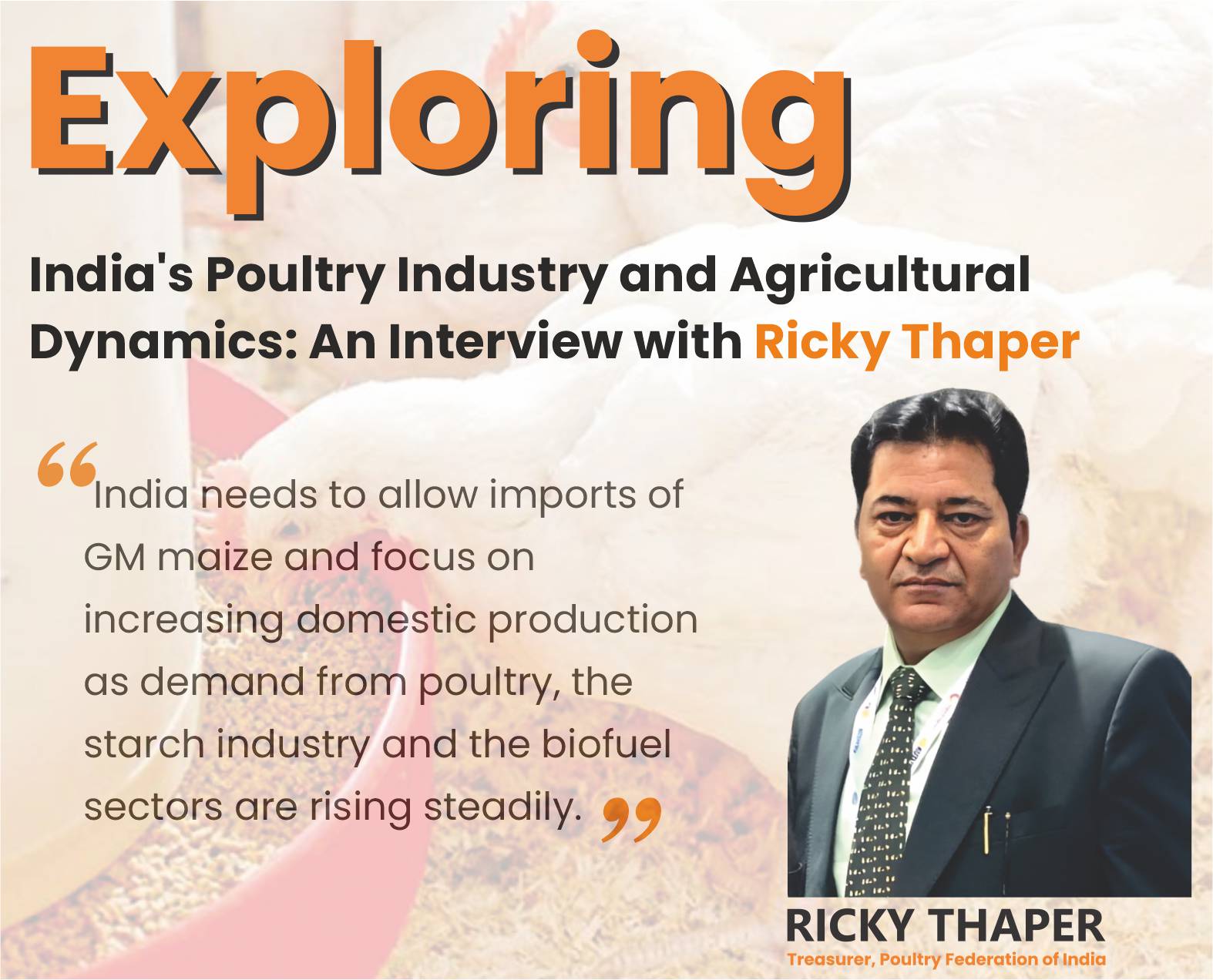

Exploring India’s Poultry Industry and Agricultural Dynamics: An Interview with Ricky Thaper

Mr. Ricky Thaper is the Treasurer of the Poultry Federation of India. With over 35 years of experience in the poultry industry, Mr. Thaper has participated in numerous specialized courses and programs worldwide. Throughout his career, Mr. Thaper has attended prestigious international events including the International Poultry Exposition in Atlanta, USA; the International Exposition for Food Processors in San Francisco, USA; the World’s Poultry Congress in Montreal, Canada; VIV Turkey in Istanbul, Turkey; SPACE Poultry and Livestock Exhibition in Rennes, France; and VIV EUROPE in Utrecht, The Netherlands, among others.

As part of the esteemed Cochran Fellowship Program, Mr. Thaper attended poultry and aqua feed preparation short course at Texas A&M University, USA in 2000. Additionally, he completed courses on extrusion processes at the Food Protein Research and Development Centre, Texas Engineering Experiment Station, Texas A&M University, in 2005, and on soybean processing at the National Soybean Research Centre, University of Illinois Urbana-Champaign, USA in 2008.

Mr. Thaper actively engages and collaborates with global poultry communities, advocating for industry advancements. His commitment to animal care and passion for the poultry sector has garnered him multiple awards at national and international events over the past three decades.

Furthermore, Mr. Thaper provides insights to the Reserve Bank of India (RBI) Inflation Analysis Team on future price movements and the food price outlook of poultry meat and feed at regular intervals. Mr. Thaper has authored several articles on the poultry sector, which have been published in numerous national and international journals. Additionally, he has delivered numerous lectures on various global platforms..

In an exclusive e-interview by Mr. Ravinder Kumar, Managing Editor of Poultry Creations, with Mr. Ricky Thaper, Treasurer of the Poultry Federation of India, discuss on the current state and future prospects of the poultry industry in India, along with insights into the country’s agricultural challenges and strategies for self-sufficiency.

Poultry Creations: What is the current level of poultry meat production and consumption in India? What projection do you have for the coming years?

Ricky Thaper: Poultry production in India has undergone significant growth in the last four decades, transitioning from conventional farming practices to commercial production systems with state-of-the-art technological interventions.

Currently, the total poultry population in India is 851.81 million (as per the 20th Livestock Census), with egg production reaching around 129.60 billion during 2021-22. According to the Food and Agriculture Organization Corporate Statistical Database (FAOSTAT) production data for 2021, India globally ranks second in egg production and fifth in meat production. Egg production in the country has increased from 78.48 billion in 2014-15 to 138.38 billion in 2022-23, with a Compound Annual Growth Rate (CAGR) of 7.35% over the past 9 years. India’s meat production has risen from 6.69 million tonnes (MTs) in 2014-15 (April-March) to 9.77 MT in 2022-23. The annual poultry meat production is estimated at 4.99 MT. The increase in average income and urban population has led to a tremendous increase in poultry demand and steady consumption growth over the years. Poultry meat production was only one million tonnes (MT) during 2001-2002-3. While the poultry sector is one of the fastest-growing sectors in the country, it is dominated by the wet market. According to a report by the Confederation of Indian Industry, the shift in demand from live birds to fresh chilled and frozen poultry products has been rather slow, and processing levels are also at a lower level of 6% of the total production. The aim is to increase processing to 20-30% of the output in the next decade. There is huge potential for India to increase poultry production through rapid improvements in genetic animal health and feeding practices.

Poultry Creations: How much of the supply of cereals and oilseeds is sourced from grains produced in India? Additionally, what proportion of imported grains does the poultry sector require?

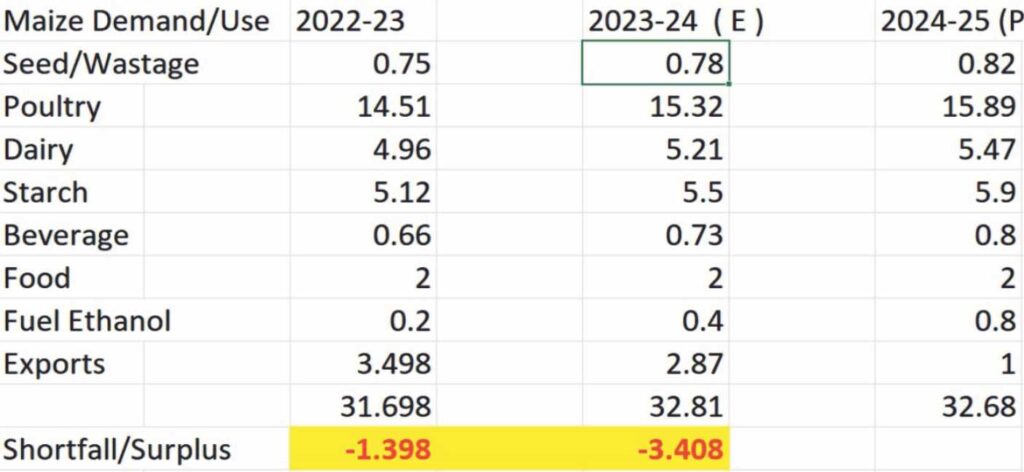

Ricky Thaper: India has been self-sufficient in cereals such as rice and wheat, and the country has been the biggest global exporter of rice for the last several decades. In terms of oilseeds, India imports about 58% of its annual requirement of edible oils, mostly palm, soybean and sunflower oils. India’s domestic production of soybean ranks as the second-largest producer of oil after mustard seed. The demand for soymeal is largely met through domestic production. However, in 2021-22, India allowed 1.2 million tonnes of genetically modified (GM) soymeal to help the poultry industry after animal feed prices tripled in a year to a record high. In addition to soymeal, the poultry sector also uses maize as a key ingredient of poultry feed. However, with the government aiming to produce ethanol from maize instead of sugarcane, there may be a shortfall in domestic supplies, which would meet the demand of both poultry and the biofuel sector. India needs to allow imports of GM maize and focus on increasing domestic production as demand from poultry, the starch industry and the biofuel sectors are rising steadily.

Poultry Creations: India is making great efforts to become a self-sufficient nation in agriculture, except in the case of vegetable oils. Can it achieve this challenge, or will it, like China, eventually become a constant importer of certain products, as happened years ago with soybean meal?

Ricky Thaper: India is heavily dependent on imports for edible oil, as currently about 58% of the total cooking oil demand is met through imports. Edible oils (crude oils) such as palm, soybean and sunflower are imported from countries like Indonesia, Malaysia, Argentina and Ukraine. Although domestic production of oilseeds such as soybean, groundnut and mustard has been increasing, demand exceeds output. A palm oil mission is underway, but the country will likely continue importing edible oils for the next decade or so. India also imports pulses, including tur (pigeon pea), urad and masoor (lentils), primarily from countries like Myanmar, Mozambique, Tanzania, Canada and Australia. India aims to source urad and tur from Brazil and Argentina and there have been several discussions with South American countries regarding pulse imports. Presently, India’s annual consumption of pulses is around 28 million tonnes, while the country imported 3 MT of pulses in the 2023 calendar year. In the next decade, India is expected to continue its import dependence for cooking oils and pulses.